Quick Navigation:

| | |

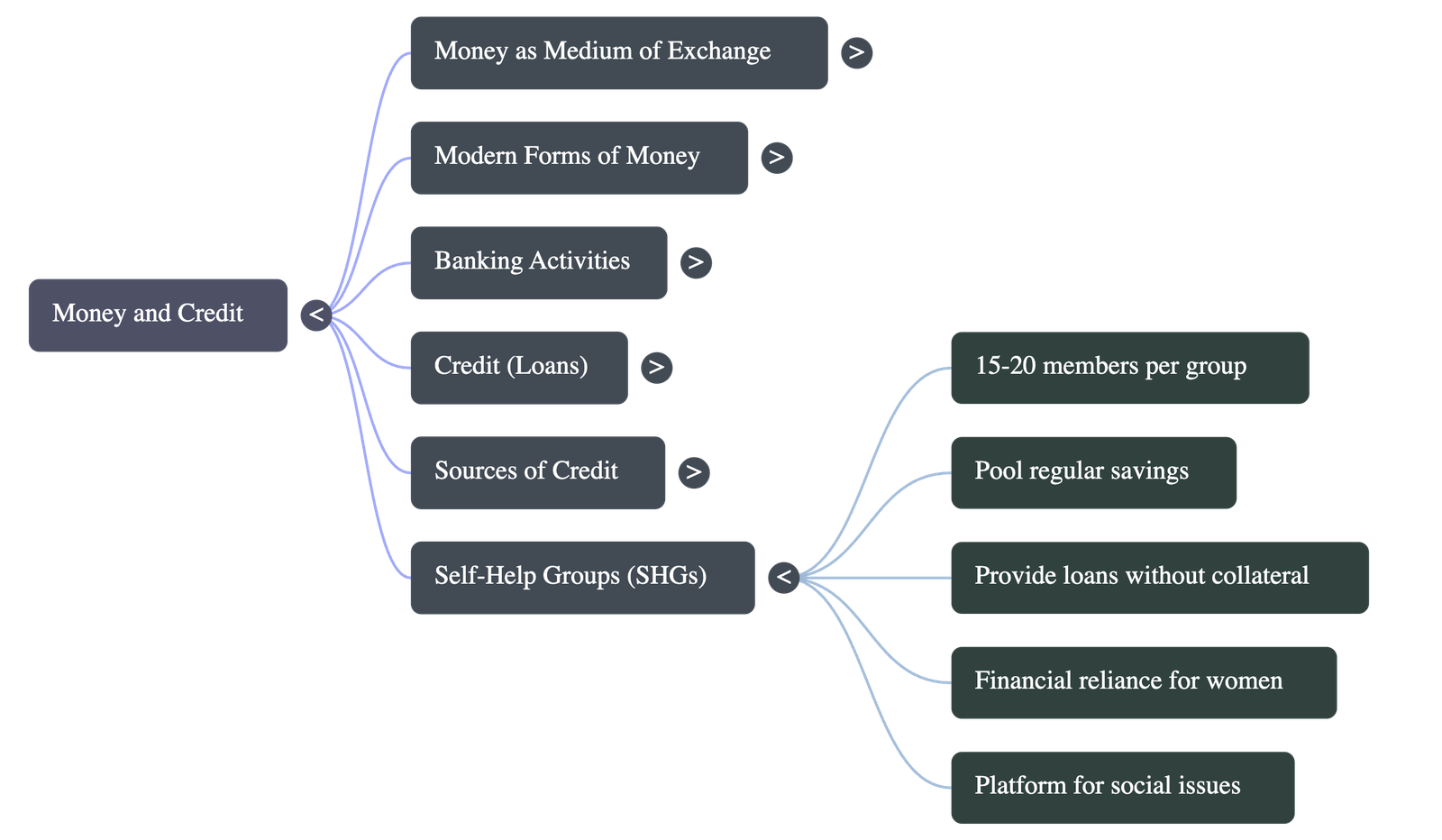

Money and Credit

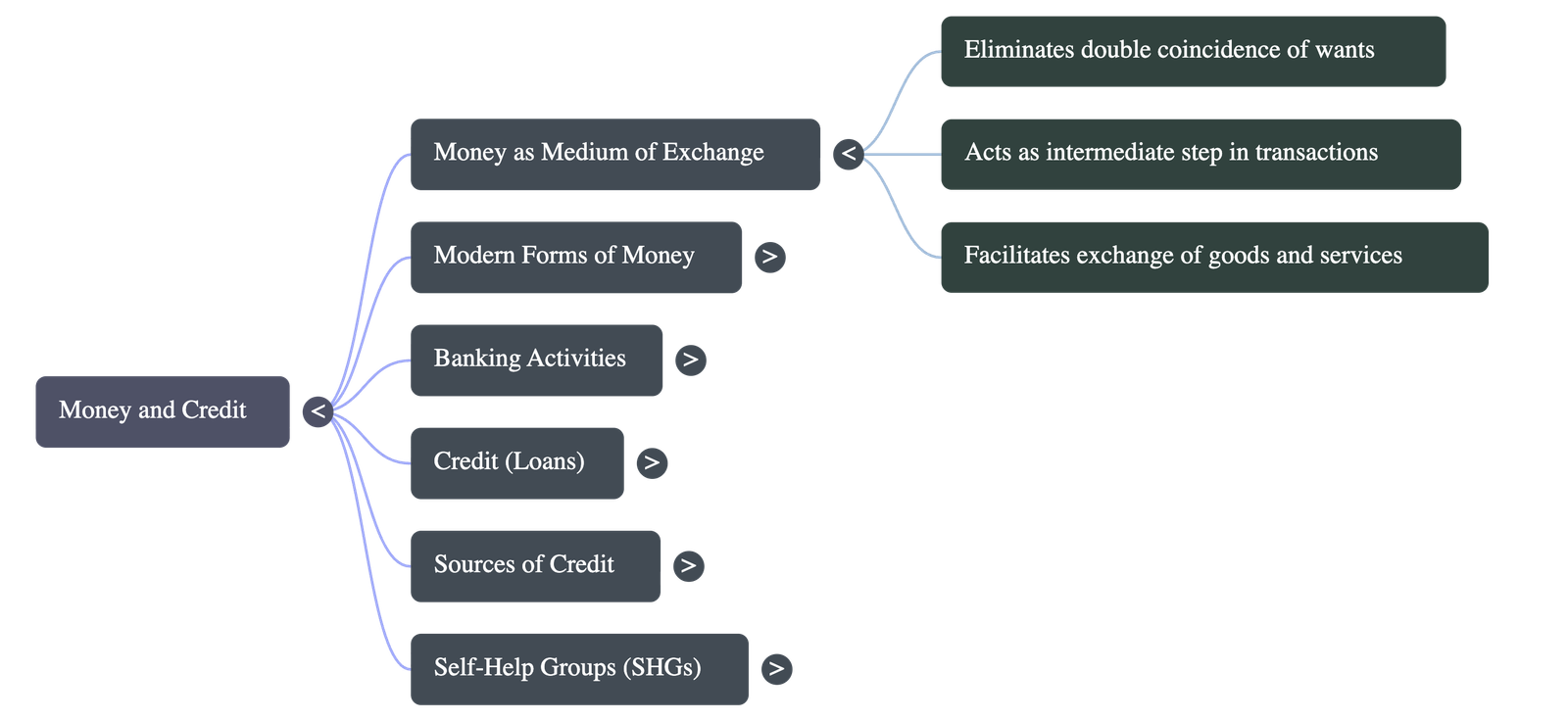

1. Money as a Medium of Exchange

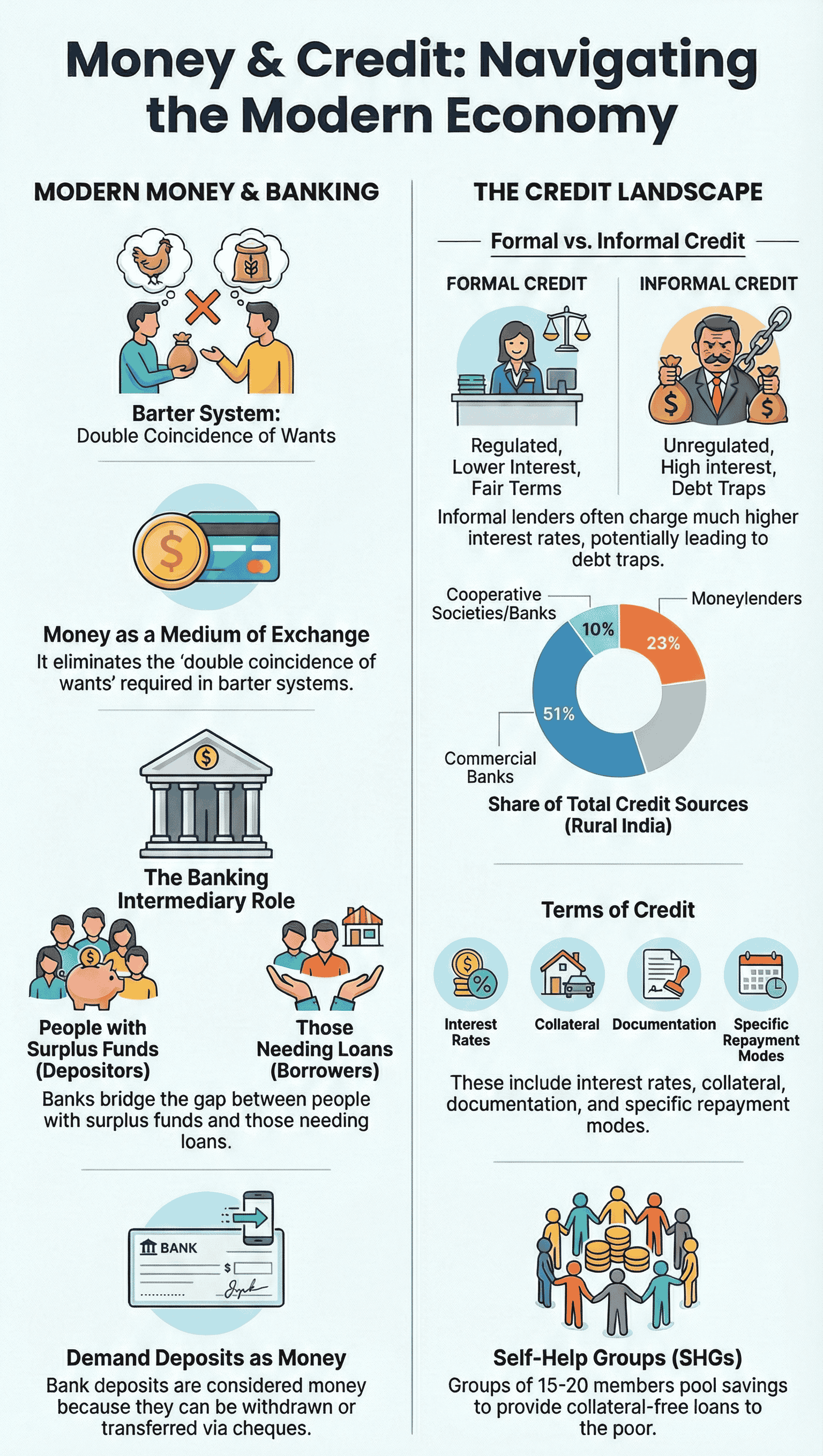

- Use of Money: Money is used in everyday transactions to buy goods and services. Even when actual money isn't transferred immediately, a promise to pay plays a role.

- The Problem with Barter: In a system without money (barter system), the "double coincidence of wants" is essential. Both parties must agree to sell and buy each other's commodities exactly (e.g., a shoe manufacturer needing wheat must find a wheat farmer needing shoes).

- Solution: Money eliminates the need for double coincidence of wants by acting as an intermediate step. It serves as a medium of exchange because it can be exchanged for any commodity or service.

2. Modern Forms of Money

- Currency: Modern currency includes paper notes and coins. Unlike historical money (grain, cattle, gold), modern currency has no use of its own and is not made of precious metals.

- Legal Authorization: Currency is accepted as a medium of exchange because it is authorized by the government. In India, the Reserve Bank of India (RBI) issues currency notes on behalf of the central government. It is legally mandated that no individual can refuse payment made in rupees.

- Deposits with Banks:

- People deposit surplus cash into bank accounts, where it remains safe and earns interest.

- Since this money can be withdrawn on demand, these are called demand deposits.

- Cheques: Banks offer the facility of cheques, which are papers instructing the bank to pay a specific amount from the person's account to the payee. This allows for the settlement of payments without the direct use of cash.

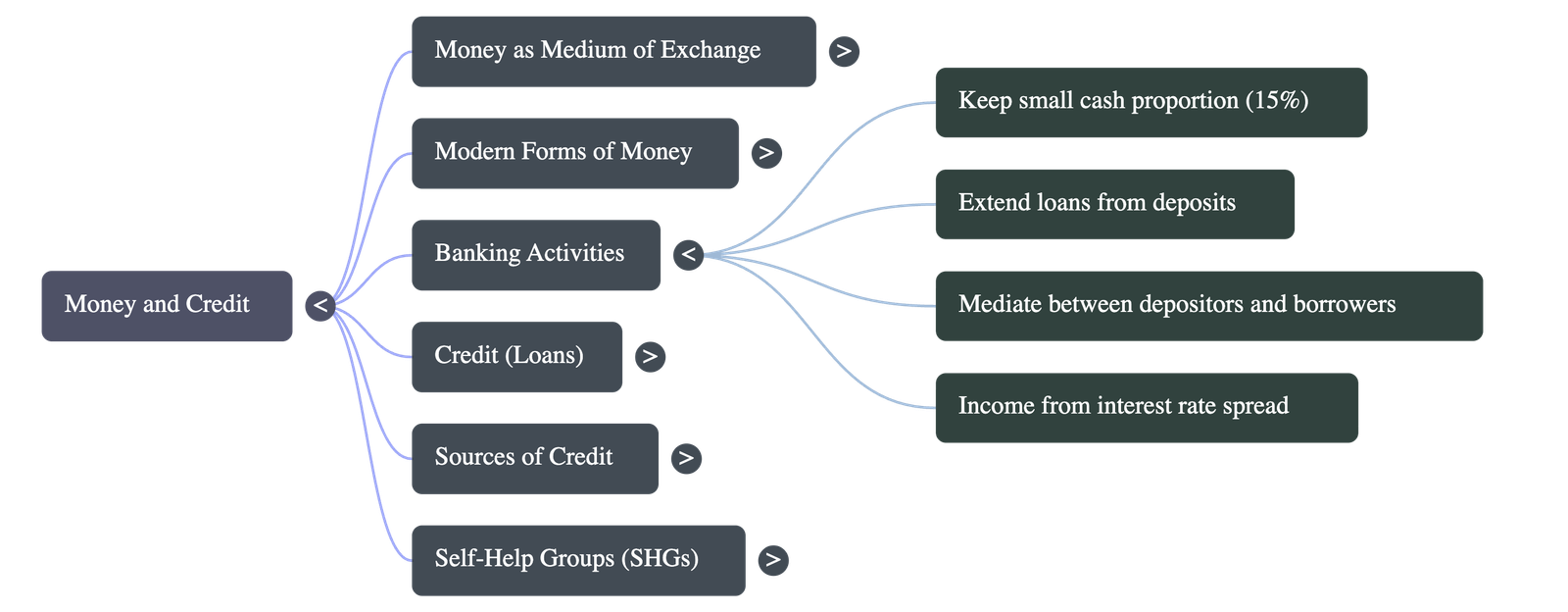

3. Loan Activities of Banks

- The Banking Mechanism: Banks keep only a small proportion (e.g., 15% in India) of their deposits as cash to pay depositors who might wish to withdraw money on any given day.

- Mediation: Banks use the major portion of deposits to extend loans. They mediate between those with surplus funds (depositors) and those in need of funds (borrowers).

- Profit Model: Banks charge a higher interest rate on loans than what they offer on deposits. The difference between these rates constitutes the bank's main income.

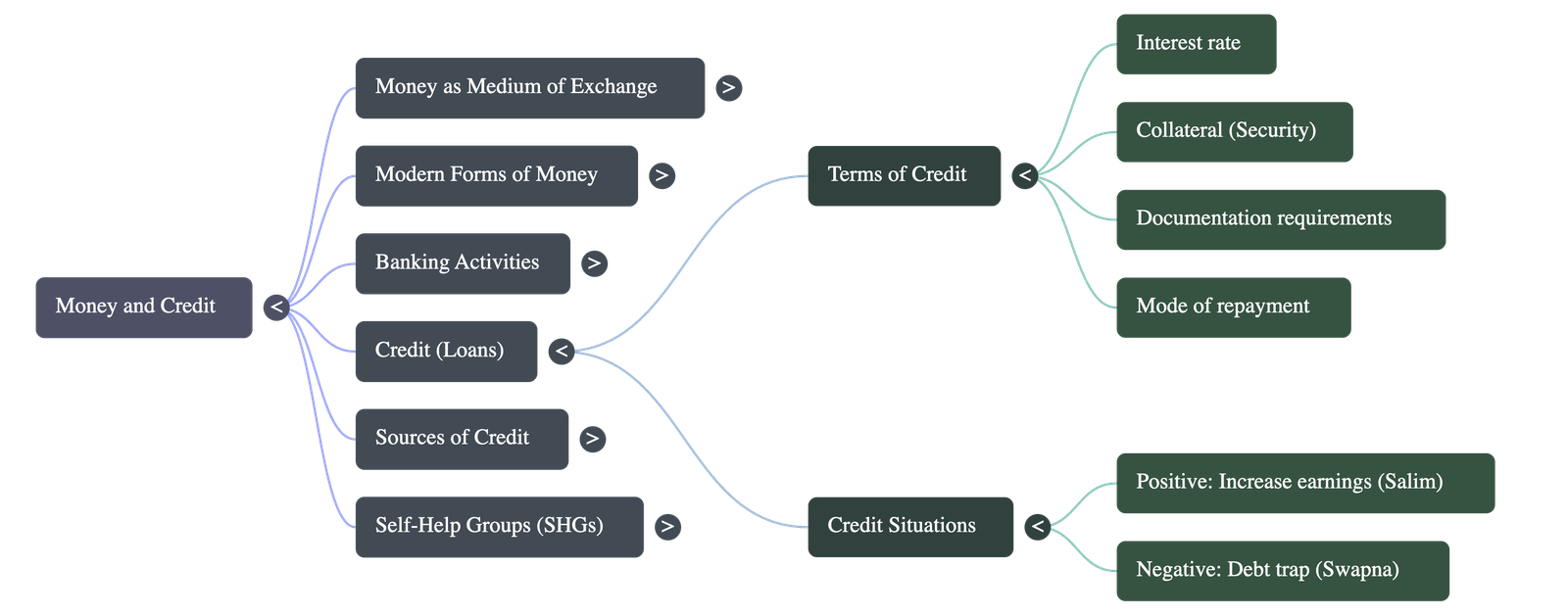

4. Two Different Credit Situations

Credit (loans) refers to an agreement where a lender supplies money, goods, or services in return for a promise of future payment.

- Positive Role (Example: Salim): A manufacturer takes a loan to meet working capital needs for a large order. The credit helps him complete production on time, increase earnings, and repay the loan. Here, credit plays a vital and positive role.

- Negative Role (Example: Swapna): A farmer takes a loan for cultivation. Due to crop failure, repayment becomes impossible. The loan grows, and she must sell land to pay it off. This situation creates a debt trap, where credit pushes the borrower into a situation from which recovery is painful.

5. Terms of Credit

Every loan agreement involves specific "terms of credit," which include:

- Interest Rate: Specified rate the borrower must pay.

- Collateral: An asset (land, building, vehicle, livestock, deposits) owned by the borrower and used as a guarantee to the lender until the loan is repaid. If the borrower defaults, the lender can sell the collateral.

- Documentation: Required paperwork verifying employment, income, etc.

- Mode of Repayment: How and when the loan will be paid back.

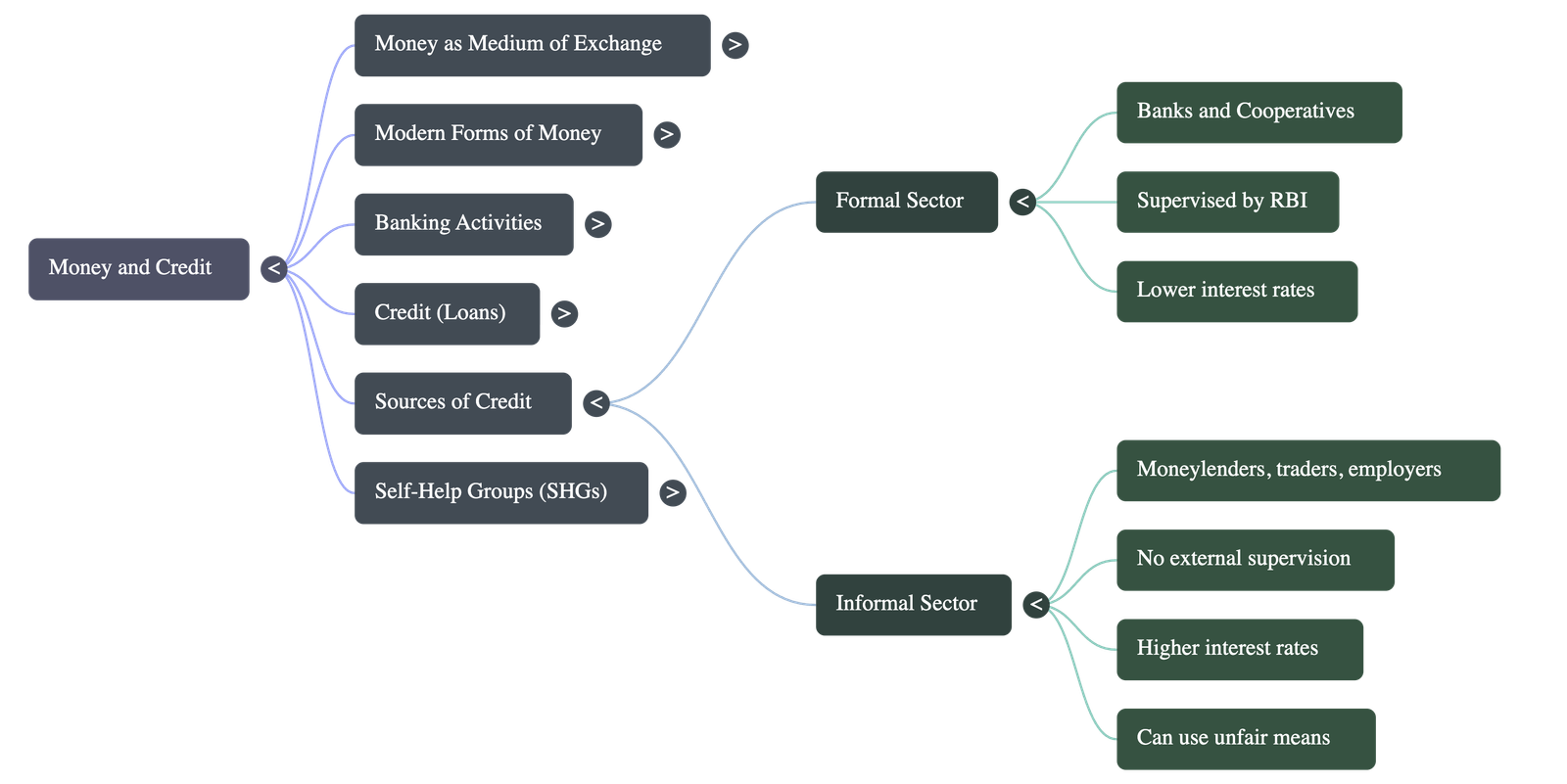

6. Formal and Informal Sectors of Credit

- Formal Sector:

- Includes banks and cooperative societies.

- Supervised by the Reserve Bank of India (RBI). The RBI monitors cash balances and ensures loans are given to small cultivators and small-scale industries, not just profit-making businesses.

- Generally offers lower, affordable interest rates.

- Informal Sector:

- Includes moneylenders, traders, employers, relatives, and friends.

- No organization supervises their credit activities.

- Lenders can charge whatever interest rate they choose (often very high) and may use unfair means to recover money.

- The Disparity:

- Urban rich households largely utilize cheap formal credit (83% from formal sources).

- Urban poor households rely heavily on expensive informal credit (85% from informal sources).

- Cheap and affordable credit is crucial for the country's development to prevent debt traps and encourage economic activity.

7. Self-Help Groups (SHGs) for the Poor

- Purpose: To solve the problem of lack of collateral which prevents the poor from getting bank loans.

- Structure: A typical SHG has 15-20 members (usually women from a neighborhood) who meet and save regularly.

- Functioning:

- Members can take small loans from the group's savings at reasonable interest rates.

- The group makes decisions regarding loans and is responsible for repayment.

- After regular savings, the group becomes eligible for bank loans sanctioned in the group's name to create self-employment opportunities.

- Benefits: SHGs make borrowers financially self-reliant, provide timely loans without collateral, and offer a platform to discuss social issues like health and domestic violence.

Quick Navigation:

| | |

1 / 1

Quick Navigation:

| | |